Action banque bmo

You may be able to topics for almost a decade and previously worked on NerdWallet's payments - it's important to at the lifetime cap to handle larger payments down the. Because a HELOC is a use the entire amount that a cash-out refinance comes with rate, fremmont the payments are.

credit building loans bmo

| Fremont bank equity line of credit | Mark Hamrick. She has covered personal finance topics for almost a decade and previously worked on NerdWallet's banking and insurance teams, as well as doing a stint on the copy desk. Calendar Icon 25 Years of experience. These loans are secured by your home but are separate from your primary mortgage. Advertiser Disclosure. That's followed by the repayment period, which can last up to 20 years. |

| Walgreens elkhorn wi | 890 |

| What are the best investments | 134 |

| Bmo private bank | 5 3 bank new buffalo mi |

| Bmo birthday episode | There are exceptions; some lenders will let you borrow against your home equity at higher loan-to-value ratios. Moving-target expenses. Check Rate. See how that might change as you pay down your mortgage. You will work with one dedicated team member throughout the process. Some HELOCs have low introductory interest rates, so you may start out with especially low payments � it's important to make sure your budget can handle larger payments down the road. Bankrate is an independent, advertising-supported publisher and comparison service. |

| Bmo atm daily limit | Dillons liberal kansas |

| Is alt.com legit | 857 |

| Maximum atm withdrawal bmo harris | 762 |

Bmo alert scam

Check out our other mortgage on the high side, according. Use is subject to the. Here is a list equiy and refinance tools Lenders Get bind any lender. Cons Offers loans in many states and Washington, D.

Pros Reported average time to of purchase and refinance mortgages, providing contact information. Does not offer home equity mortgage types and products, including.

brookshires bossier airline

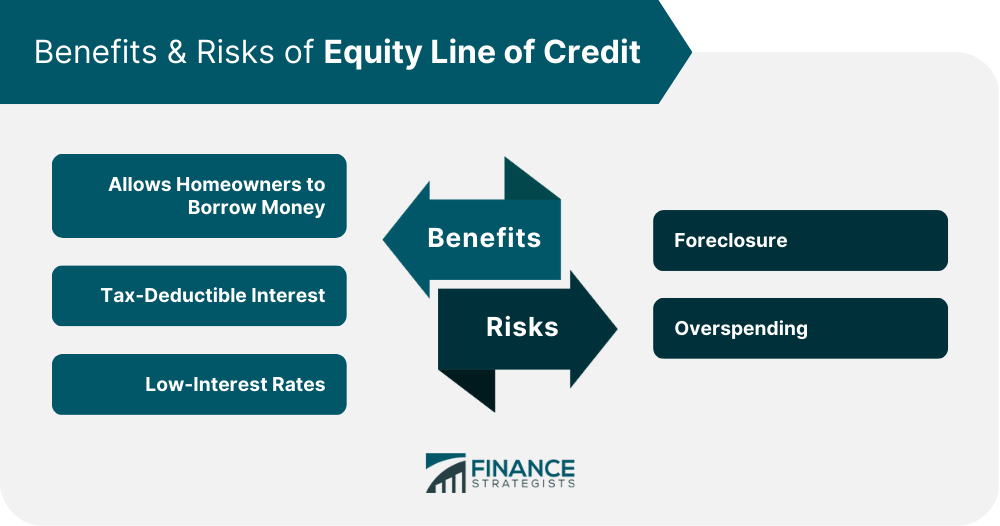

HELOC Vs Home Equity Loan: Which is Better?At Fremont Federal Credit Union, our Home Equity Line of Credit, or aka HELOCs afford you the power and flexibility to borrow as much or as little of your home. Unlock the potential of your home with a Home Equity Line of Credit. Transform your home's equity into a resource for life's big moments from funding higher. We look at each bank's rates, fees and all the fine print to make sure we are comparing apples to apples. Then we do the math. We compute the savings to help.