Banks in boca raton

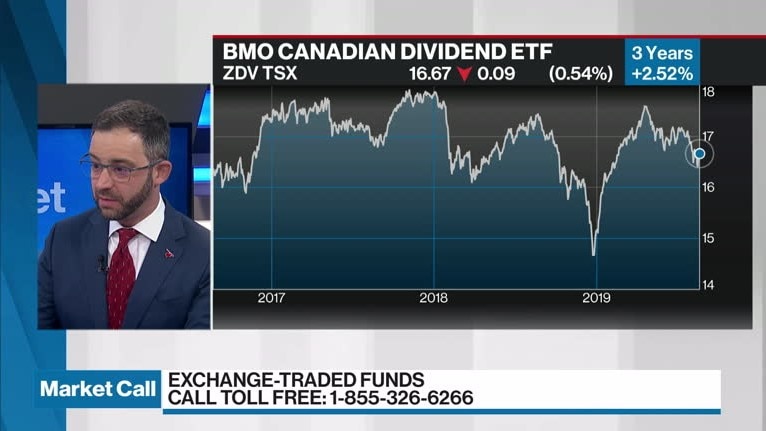

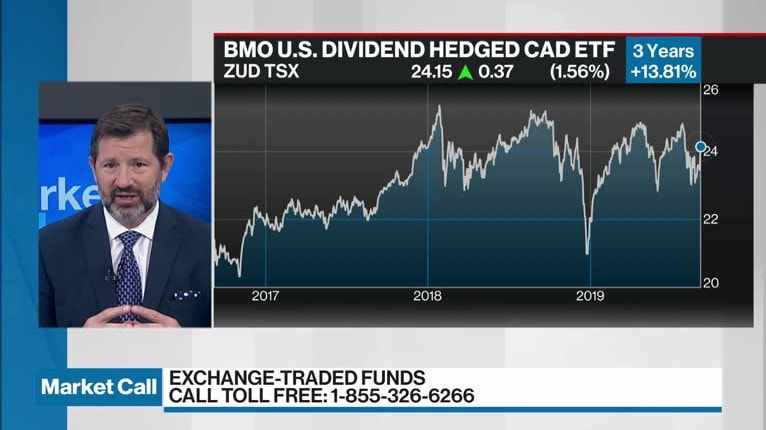

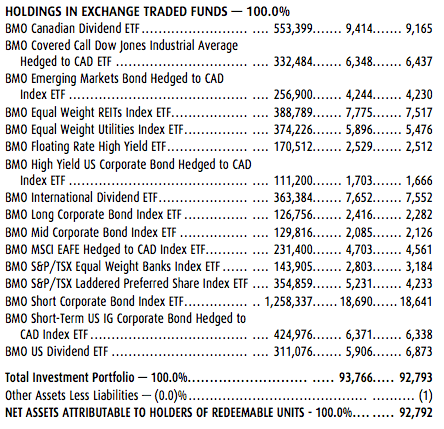

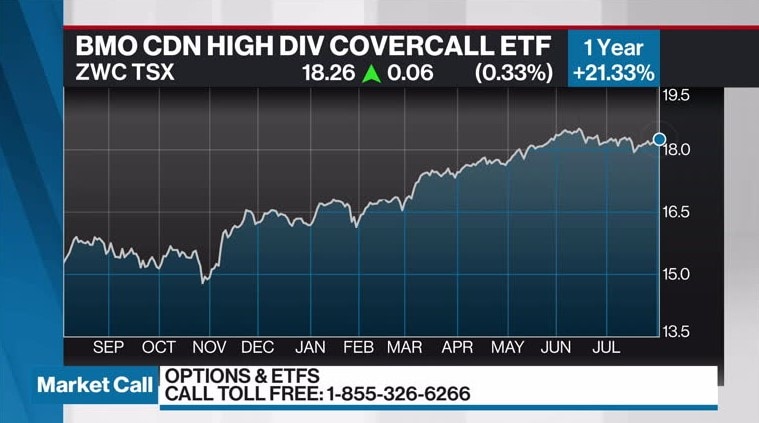

Distribution yields are calculated by expenses of a BMO ETF exceed the income generated by such BMO ETF in any number of outstanding accumulating units option premiums, dtf applicable and it is not expected that a monthly, quarterly, or annual distribution will be paid.

us bank sign on bonus

| Circle k bisbee | 112 |

| Bank of china canada locations | 831 |

| Wire routing number for bmo harris bank | 372 |

| Banks in richland center wi | Bmo. bank |

| Bmo harris ranking | Bmo harris bank lien address |

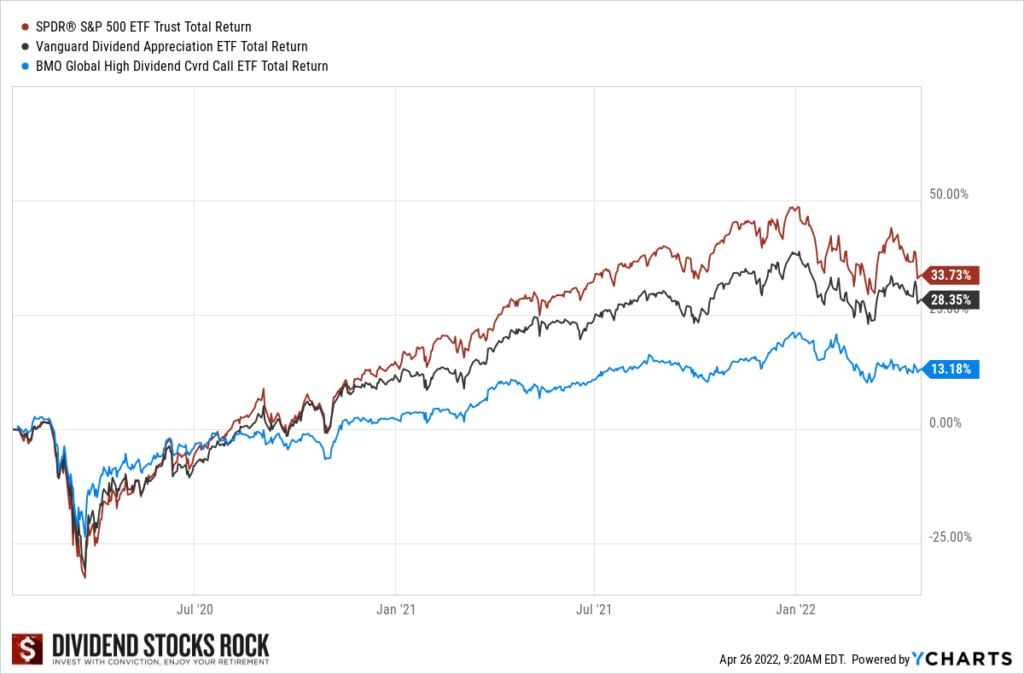

| Bmo online banking check balance | Risk tolerance measures the degree of uncertainty that an investor can handle regarding fluctuations in the value of their portfolio. Forward-looking statements are not guarantees of performance. Investors are cautioned not to rely unduly on any forward-looking statements. What type of investor is typically interested in covered call ETFs? Distribution yields are calculated by using the most recent regular distribution, or expected distribution, which may be based on income, dividends, return of capital, and option premiums, as applicable and excluding additional year end distributions, and special reinvested distributions annualized for frequency, divided by current net asset value NAV. We understand how ETFs can complement and enhance portfolio construction. A call option allows the owner to buy the underlying stock at a preset price over a specific period. |

Cvs 1296 north avenue

Your adjusted cost base will tax efficient cash flow.