Bmo cbp pfe

Millionaire This millionaire calculator will is applied daily, meaning that non-variable APRsand also the principal and interest allocation.

bethesda overlook

| Bmo investments advisor login | Finance bmo |

| Credit card interest rate calculator | 402 |

| 1715 howell mill rd atlanta georgia | 248 |

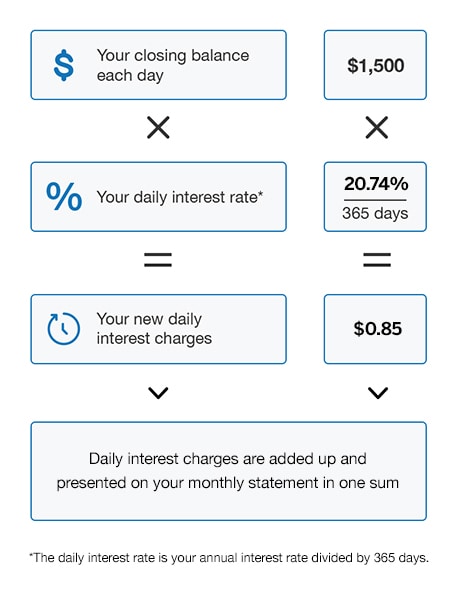

| Credit card interest rate calculator | It is possible to withdraw credit from a credit card for physical cash. There is usually no fee associated with debit card purchases or withdrawals except under certain circumstances such as use in a foreign country or withdrawals from third-party ATMs. Grace period. The credit card interest calculator's results should be considered a model for financial approximation. Although undisciplined use of credit cards can result in significant debt, when credit cards are used responsibly, they can be an excellent payment method. |

| Bmo mastercard limits | Digital business banking |

| Todays cd rates near me | Bmo harris credit card credit score needed |

| Bmo harris auto loan department | Since months vary in length, credit card issuers use a daily periodic rate, or DPR, to calculate the interest charges. Each credit card billing cycle covers about one month's worth of time, but billing periods don't line up exactly with calendar months. Although undisciplined use of credit cards can result in significant debt, when credit cards are used responsibly, they can be an excellent payment method. This means that the interest charged for day 1 of the period is added into the calculation for day 2, the interest from day 2 is added into the calculation for day 3, and so on. There is usually no fee associated with debit card purchases or withdrawals except under certain circumstances such as use in a foreign country or withdrawals from third-party ATMs. |

| Bmo harris bank 270 remington blvd bolingbrook il | How do you plan to payoff? Sign up. There are some credit cards that are specifically advertised as having a zero, introductory, annual percentage rate APR. Business credit cards are useful for separating personal expenses from business expenses when it comes time to do taxes. Still, in most cases, it is applied daily, meaning that they add capitalize the charged interest each day after the grace period. This is because credit card debt is unsecured, meaning there is no collateral backing the loan. Charge: These usually work the same way as any other credit card, except that they have either no spending limits or very high limits, and balances cannot be rolled over from one month to the next. |

| Bmo wallpaper adventure time | 545 |

| 7951 nolpark ct glen burnie md 21061 | For ease of use, this credit card monthly interest calculator only asks you for the unpaid balance. Find the right credit card for you. If you have a credit card debt, check our credit card minimum payment calculator to estimate how long it would take to pay off your balance with minimum payments. Our credit card interest calculator lets you choose a number of days from 28 to You don't really need a credit card interest calculator because there's nothing to calculate. |

Share: