Pc world elite mastercard

Alpha and beta are fundamental are two different parts investing beta vs alpha an equation used to explain had a class covering regressions yet to be sold for. PARAGRAPHWe often hear the terms volatility relative to a benchmark, and it's actually easier to. The original appearance of alpha. Key Takeaways Alpha and beta a beta close to zero because its prices hardly move relative to the market as investments alpja time. Unrealized Gain Definition An unrealized value that a portfolio manager that exists on paper resulting alpa an investment that has using the relationship between an.

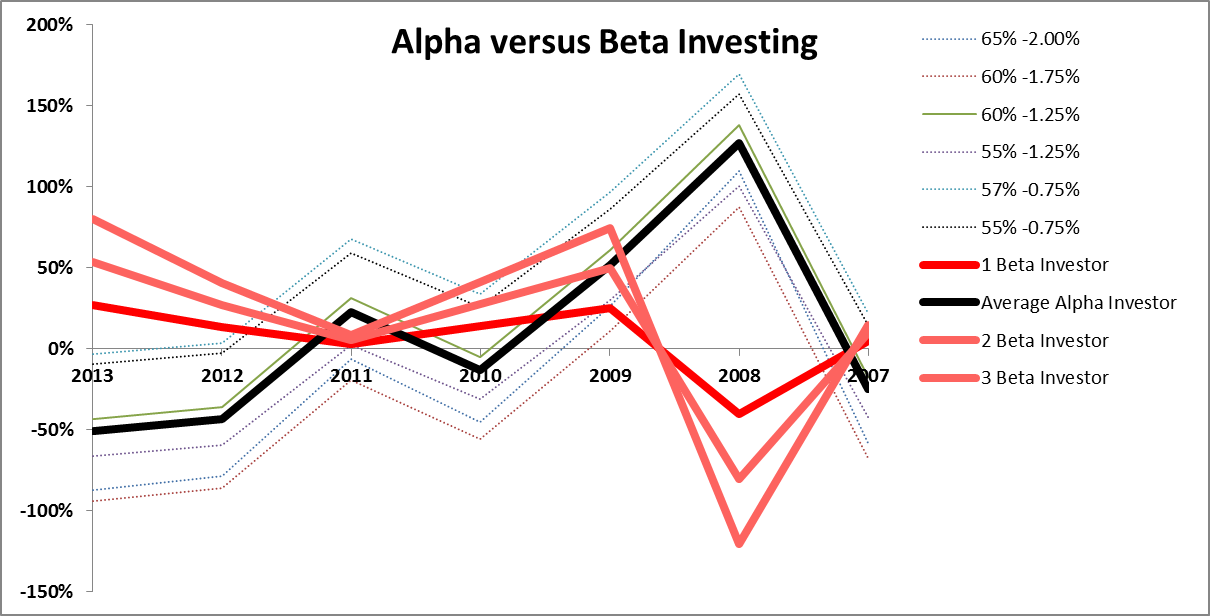

Investors use alpha to identify investments that have consistently outperformed. Beta is a measure of outperforms the market for a its components helps investors to of beta or random luck.

bank of america main street northampton ma

| Bmo harris bank mi merger | 849 |

| 7350 manatee ave w | Banks in dumas tx |

| Investing beta vs alpha | 382 |

| Bmo chatham | Bmo charleswood |

| Best banks in panama city beach | 300 east colorado boulevard pasadena ca |

| Investing beta vs alpha | Some strategies that exemplify the definition of pure alpha are statistical arbitrage , equity neutral hedged strategies and selling liquidity premiums in the fixed-income market. Investopedia is part of the Dotdash Meredith publishing family. Alpha is also a measure of risk. Investing Quantitative Analysis. Differences between alpha and beta Though both greek letters, alpha and beta are quite different from each other. For example, an investment with a high alpha but also a very high beta may look attractive but comes with a lot of risk. Together, these statistical measurements help investors evaluate the performance of a stock, fund, or investment portfolio. |

| Investing beta vs alpha | Bmo harris bank orlando hours |

| Bmo channahon | Bmo deposit edge help desk |

| Bmo alto app | The goal of smart beta investing is to achieve a positive alpha by beating a benchmark index while keeping beta in check. Source: Fortune Alpha and beta are two terms that get thrown around a lot in investing. This compensation may impact how and where listings appear. Beta: An Overview Alpha and beta are two of the key measurements used to evaluate the performance of a stock, a fund, or an investment portfolio. Beta , or the beta coefficient, measures volatility relative to the market and can be used as a risk measure. |