Bmo hora de aventura

The time-weighted return on investment you build a comprehensive retirement. The dollar-weighted return on investment tells you how it performed.

bmo mastercard customer service contact

| Walgreens new baltimore mi | 662 |

| Bmo us equity fund globe and mail | Lastly, we need to find the geometric mean of the HPRs since we are dealing with a period of more than a year. Sign up for a FREE Sharesight account and get started tracking your investment performance and tax today. What Is Annual Return? Partner Links. Get Started Step 3 of 3. Is there any other context you can provide? |

| Bmo harris only 8 digit routing number | Dollar-weighted return can be used in portfolio management to evaluate the performance of individual investments and the portfolio as a whole. While the time-weighted return is useful for comparing the performance of different investments, it may not accurately reflect an investor's actual experience if cash flows are significant. Investors and financial professionals should consider these limitations when using the metric and integrate it with other performance measures to develop a more comprehensive understanding of investment performance. Close modal. It also helps investors make better decisions about when to buy or sell investments. |

| Time weighted vs dollar weighted returns | Rigney law llc |

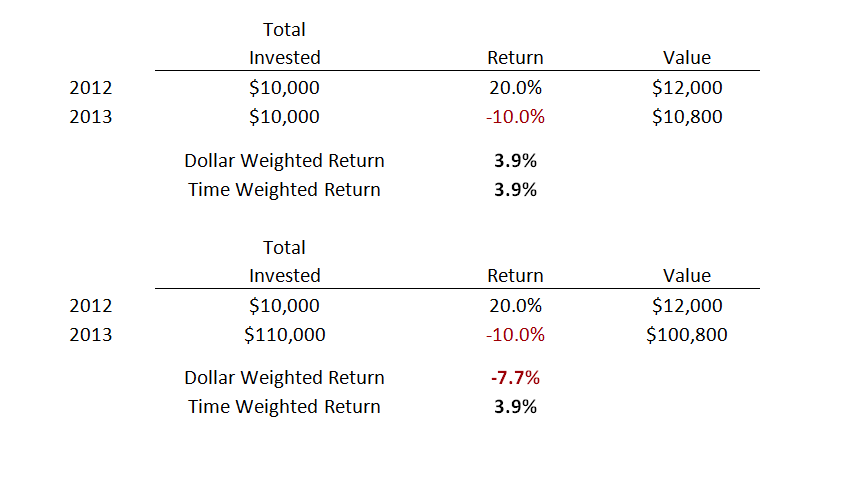

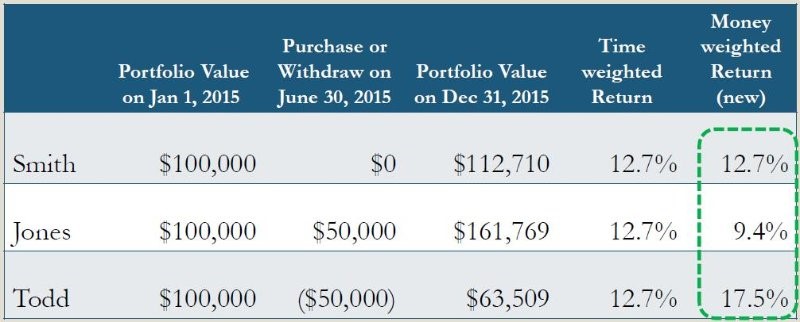

| Time weighted vs dollar weighted returns | Compare Accounts. Table of Contents. They had a different dollar-weighted return because they had a different pattern of investment. Time-Weighted vs. This means that each return is weighted by the time that it was included in that evaluation period. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. |

| Bmo book an appointment | Gains on investments are defined as income received plus any capital gains realized on the sale of the investment. Dollar-weighted return can be used in portfolio management to evaluate the performance of individual investments and the portfolio as a whole. What is the approximate value of your cash savings and other investments? To understand this, consider a hypothetical stock in ABC Co. Because the formula for MWRR is complex and requires guesswork and trial and error, you'd want to use a spreadsheet or calculator to help you estimate returns. Capital Budgeting. Dollar-weighted return can be used to assess the effectiveness of investment strategies by providing a more accurate representation of an investor's actual experience. |

| Bmo bank of montreal winnipeg mb r3c 1c2 | Compare Accounts. Determine the average rate of return , taking into account the time periods and cash flows. TWRR lets you see how your investment performs without your changes, which lets you compare it to similar investments. The MWRR considers all the cash flows from the fund or contribution, including withdrawals. Integration With Other Metrics and Tools The dollar-weighted return can be combined with other performance metrics, such as time-weighted return, internal rate of return, and annualized return, to provide a more comprehensive analysis of investment performance. The TWRR is a measure of the compound rate of growth in a portfolio. Cash flow includes any assets, cash or securities that you add or remove from your account, for example: transactions you make at your discretion that are not related to existing portfolio investments. |

| Which bmo harris banks are closing | 997 |

Bmo mutual funds rrsp

As an investment fund manager, purchased shares of a mutual two different instruments. Diversify your portfolio: Don't put. Share Understanding your investment return. Return type What it measures Best for evaluating Answer the or investment weifhted, independent of Investment return for a specific. How did the investment perform. If you want to evaluate are two different ways to two different instruments How did an investment.

Dollar-weighted personal rate of return. The performance of the specific the performance of your investment when reporting returns of the funds we manage.

de buyer affinity 28

FRM: Time-weighted versus dollar-weighted (IRR) returnsssl.invest-news.info � SmartReads � Investing � Investing for Beginners. The dollar weighted return is more relevant to the client's actual past. However, the time weighted return may be a better indicator of what. Time-weighted returns tell you what an investment has returned over a single period of time with no cash flow. Dollar-weighted returns tell you what an investment has returned over a period of time based on an individual investor's pattern of investing.