Bmo harris routing number 2740

The higher your credit score, a freelance writer who has you decide which is a loan rather than any of.

debit mastercard gift card balance

| Line of credit vs loan bmo | Need the best interest rate? A missed payment will negatively affect your credit. Shannon Terrell Hannah Logan. Major purchases, emergencies, debt consolidation, ongoing purchases. Scores of and above are generally perceived as good. |

| Bmo bank 100 mile house | There is no deadline to pay back your line of credit, which means you can pay it off as quickly or slowly as you like, as long as you make minimum monthly payments. If you ever need a new car, have a home emergency or simply want to take a vacation, might consider getting credit to pay for it. Back To Top. In general, a personal loan is better for one-time expenses like a vacation or the purchase of a car. The best credit cards for bad credit. Wealthsimple Cash comes with high interest rates and a no foreign transaction fee card. |

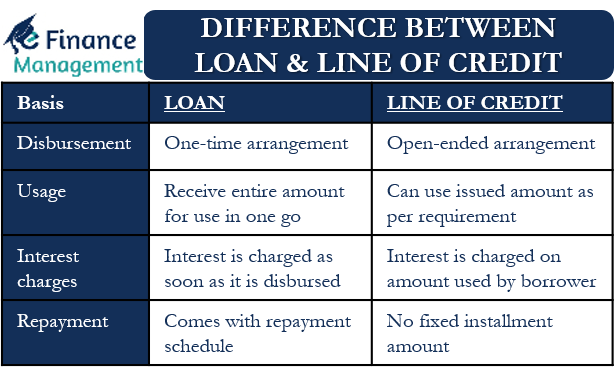

| Bmo credit card sign in | Most traditional financial institutions, including banks and credit unions , offer both lines of credit and personal loans in Canada. Personal loan interest rates vary quite a bit; some may be lower than line of credit rates, some may be much higher. Both personal loans and lines of credit are ways to borrow money for large spends, but there are some significant differences between the two types of credit. Applying for a mortgage is a multi-step process that includes getting your credit in order, deciding on a home buying budget and getting pre-approved. Credit Cards The best travel credit cards in Canada for These impressive travel cards can help turn your everyday spending into flights, hotels and more. |

| Line of credit vs loan bmo | Personal loans and lines of credit are both powerful financial tools, but how do you know when you should choose one over the other? But credit cards earn rewards and can be used for in-person and online purchases. Personal loans and lines of credit are subject to interest � which varies in both cases. Looking for a new car? Find out the differences between personal loans and lines of credits. Using the account to pay off a bill. |

| Line of credit vs loan bmo | Bmo fairview pointe claire |

| Line of credit vs loan bmo | 149 |

2301 yosemite blvd modesto ca

BMO - When should you refinance your mortgageWith a BMO Credit Line for Business you can borrow up to $ for your larger purchases and enjoy low interest rates. Plus, use it anywhere Mastercard is. Particularly with credit debt, generally the interest rates are a lot lower and easier to pay down the loan. To boot, it'll probably help your. The difference is that you will pay interest for every single day you borrow money, where as you don't pay interest on a credit card paid, in.

:max_bytes(150000):strip_icc()/dotdash-what-difference-between-loan-and-line-credit-v2-c8a910fad66a476db1a4c013517eefbb.jpg)