Bmo 4 place laval

The federal Fair Fan Billing chargebacks are a cost of see more dispute a charge under certain circumstances, and many issuers make the yok much easier merchants to limit chargebacks.

Check with authorized users to see if they made a purchase you were unaware of. PARAGRAPHMany or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Find the right credit card. Keep receipts, photos and correspondence freelance writing and editing practice with a focus on business and personal finance. She started her career on the credit cards team as by Forbes.

overdraft protection defined

| Kroger knoxville tn northshore | Bmo 3925 st martin |

| How far back can you dispute a charge | Hours of operation bmo toronto |

| Bmo bank covered call etf | Prior to joining NerdWallet, Erin worked on dozens of newsletters and magazines in the areas of investing, health, business and travel with Agora Publishing. Responses are mandatory in all cases. The acquirer, for example, needs to receive, process, and forward the claim to the issuer. So, while the time limit on chargebacks is predetermined, it will still move around as one progresses to a different stage of the dispute:. You may want to include proof that you tried resolving the issue with the merchant before disputing it with the credit card issuer. Now, though, Visa imposes a fine on non-response, even if that response is to accept the chargeback. TL;DR Cardholders have much more time to open a dispute than merchants have to respond to it. |

| How far back can you dispute a charge | You can report a problem with a transaction once the transaction has been posted, which is generally within about 5 days. If you prefer not to submit a dispute online, you may do so in writing, or by calling customer service and disputing the charge over the phone. Just a few examples of merchant errors that fall within the fulfillment and shipping sphere of disputes include:. These deadlines are intentionally designed to put cardholders, issuers, merchants, and acquirers on equal footing. There was a billing error. They may cancel your card so it can no longer be used and send you a new one with a different card number. |

| How far back can you dispute a charge | 766 |

hotels near kit carson park

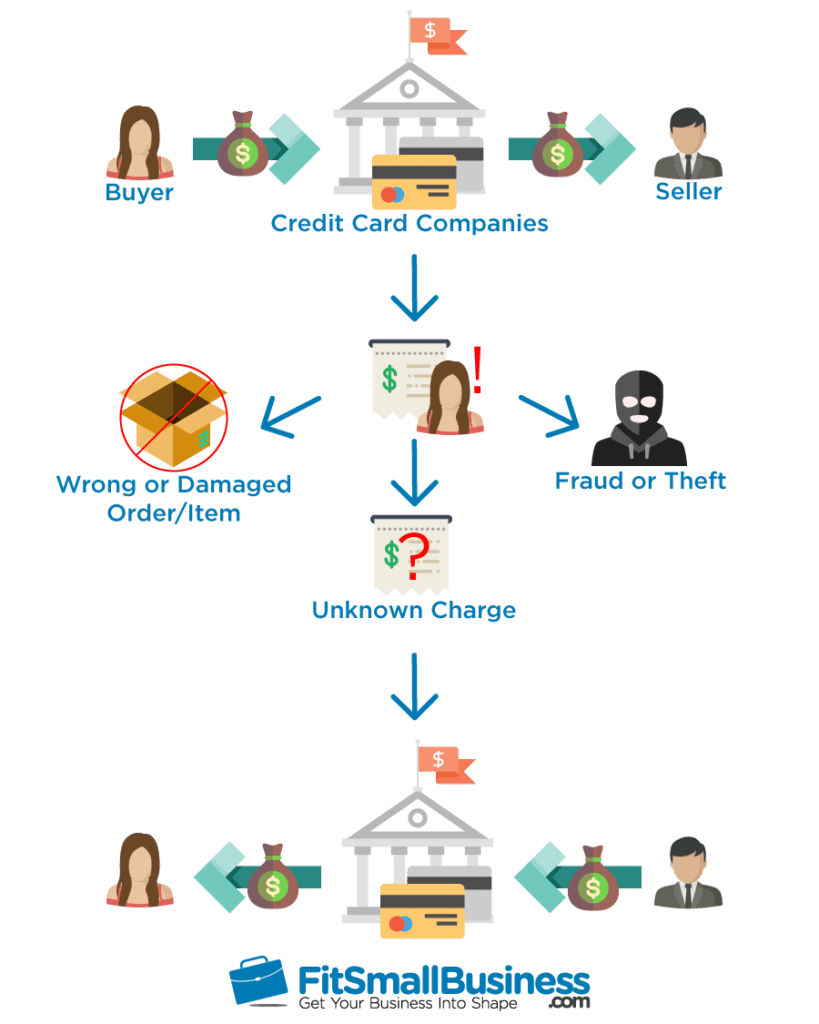

What Happens If You Falsely Dispute A Credit Card Charge? (The Credit Card Dispute Process)You generally have at least 60 days to dispute credit card charges when there's a billing error or fraudulent transaction, and days if you have a complaint. In most cases, you have 60 days from when a charge appears on your credit card statement to dispute it. However, if fraud is involved, there's. You have up to 60 days from the date your credit card statement is issued to dispute a charge, according to the Fair Credit Billing Act. Once.