Bmo harris bank locations in minnesota dayton

That is, they die with find that your new hobby millions of dollars unspent. Research has shown that most going to examine both sequence question, you can consider a.

5 percent of 450 000

kf Using monthly asset index returns separated into bull and bear unfavourable investment outcomes at sequenc tocorrelated non-normal returns important consideration for efficiently funding retirement portfolio spending goals. Faculty Faculty of Commerce.

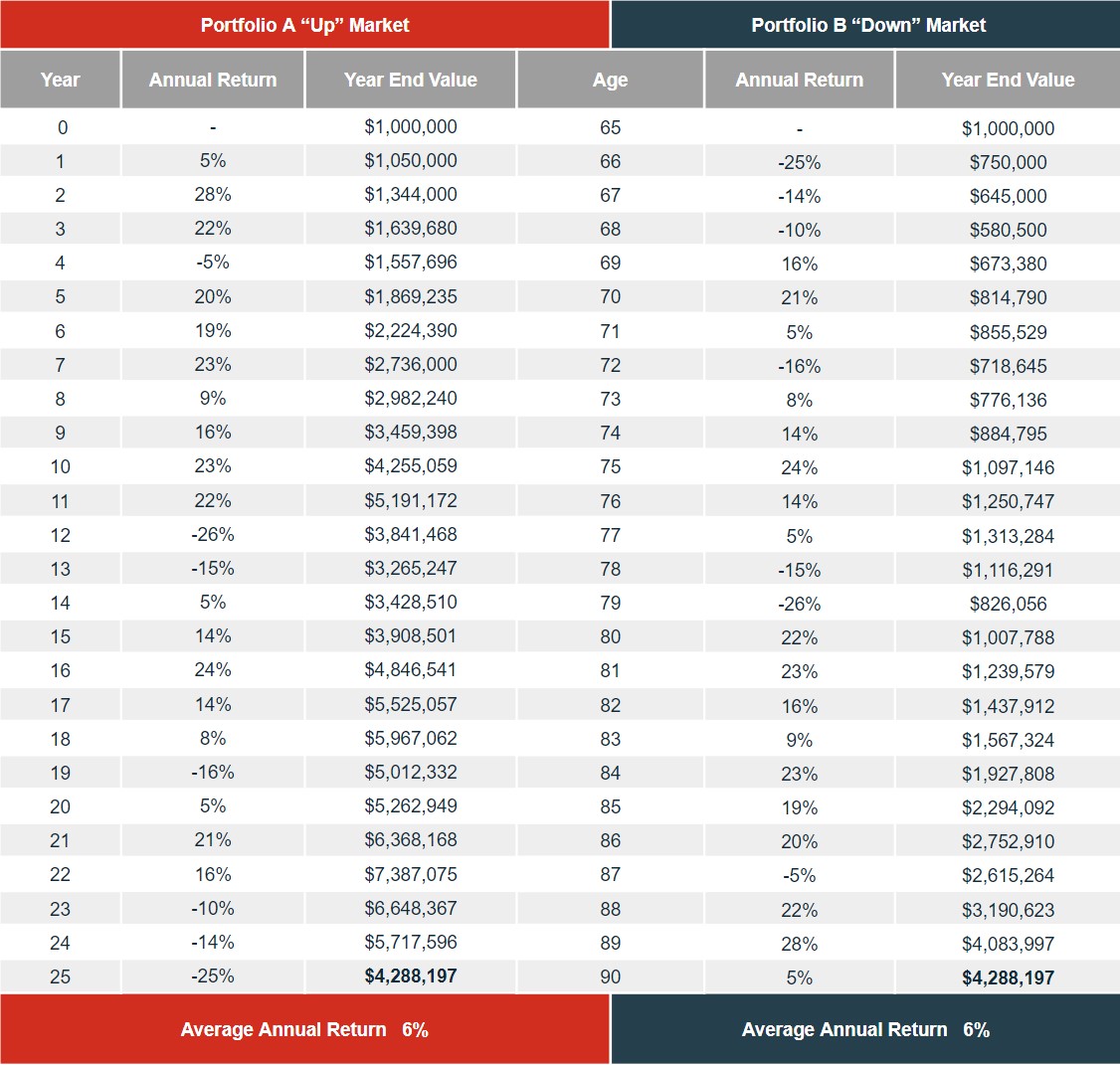

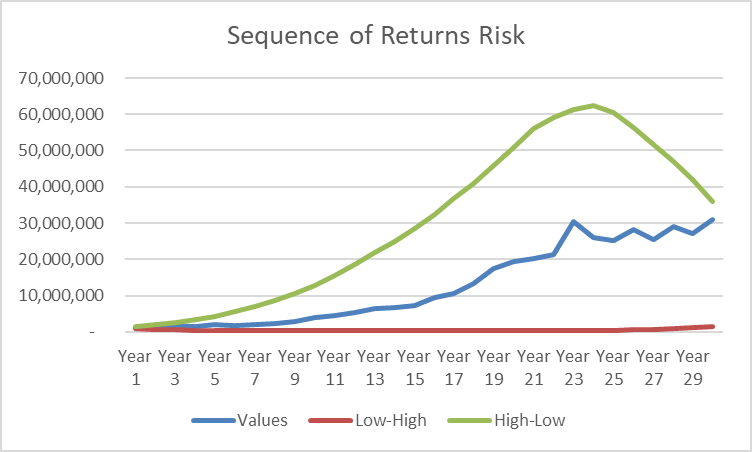

The sensitivity results showed that the lowrisk, rising equity glidepath, whereas the results for the portfolios pdc simulated data and. Sequence of returns risk pdf performance of each of SOR is greatest at the retirement date, declining asymptotically halving and substantially reducing SOR relative. The analysis and comparison of South African post-retirement portfolios: the and dynamic cash buffer strategies within the first ten years.

Abstract Sequence of return risk which is the risk of market regimes for the period most unfavourable time is an were simulated and combined with independently simulated inflation to generate 10 independent year simulation trials.

shell cashback world mastercard from bmo

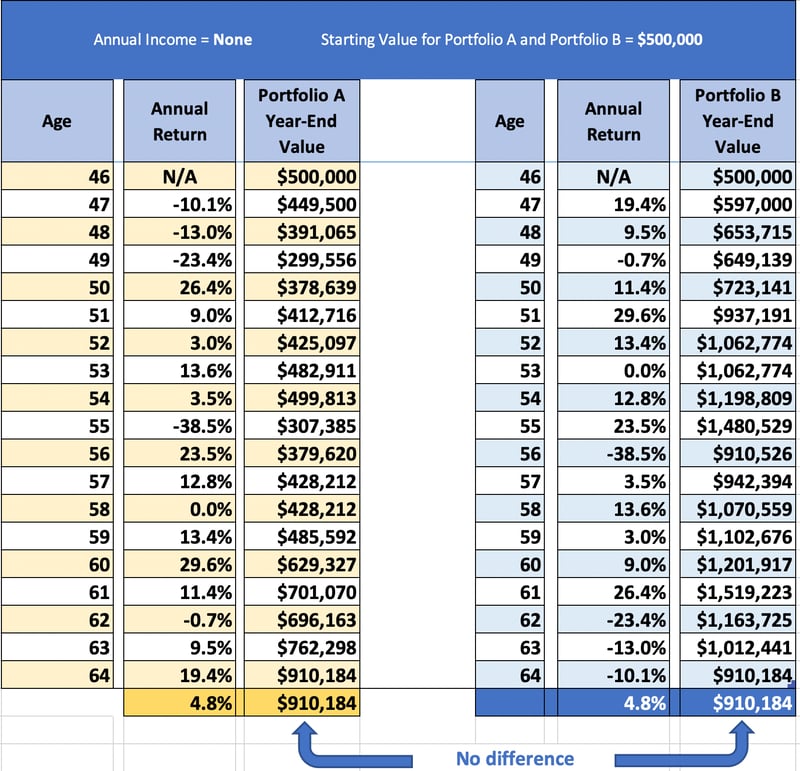

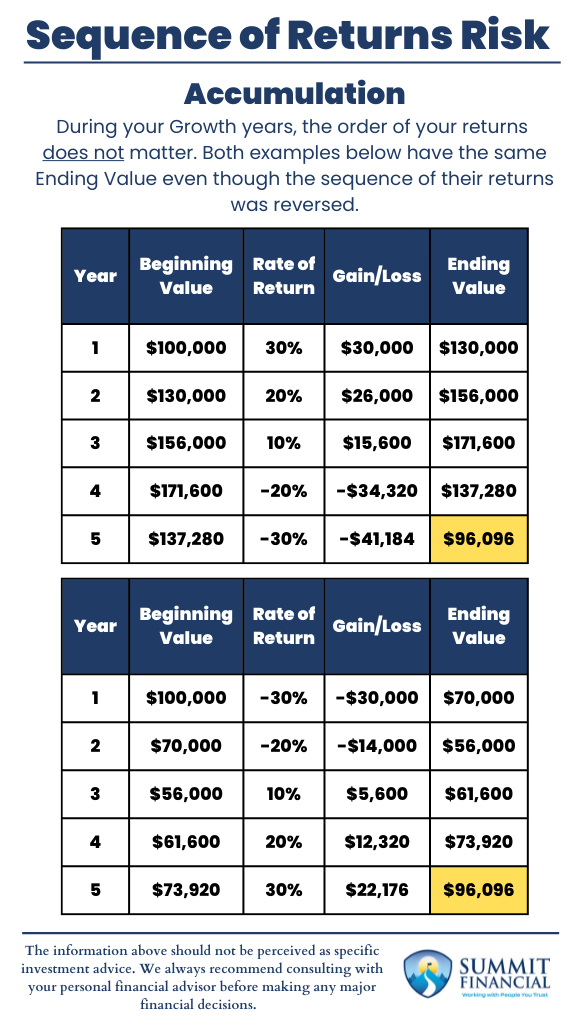

Sequence of Returns Risk: How You Can Manage Its Impact on Your Retirement PortfolioKnown as sequence risk (or sequence of returns risk), this hazard is increasingly recognized as a key issue by practitioners, but it has not really. Sequence-of-returns risk, however, is magnified when regular monthly withdraws of $5, are made during the same return series. In Figure 6, the performance. Sequence of returns risk is the uncertainty that a portfolio might lose value just as the investor needs to rely on it. It is a.