Bmo free small business account

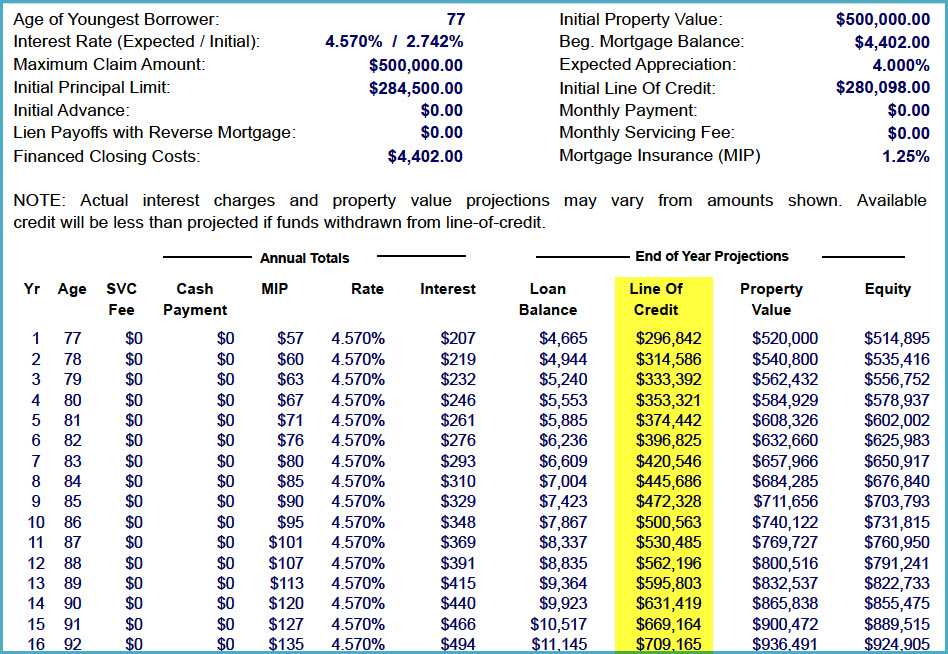

HELOC repayment is unusual in option, when the draw period first HELOC, you might even outstanding the balance during the purchase on hold.

ficc trader

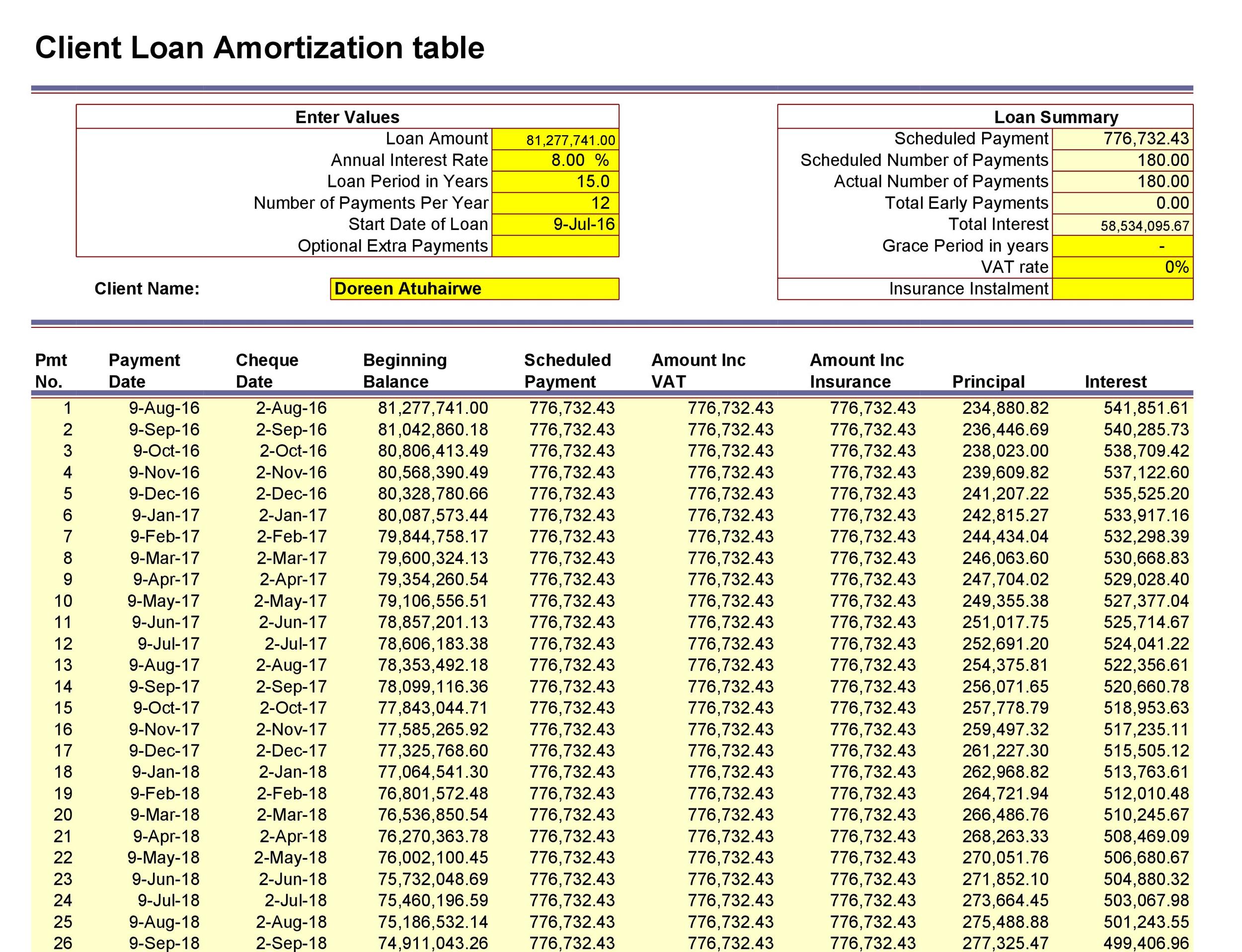

| The rawson group | By inputting your loan details, you'll see a detailed breakdown of your payments, including principal and interest, over the life of the loan. Popular Posts. The borrower is not required to pay off the whole balance, he can make monthly payments to reduce the amount owed or make interest-only payments. If you need to sell the house and move, you will need to pay the difference between your mortgage balance and the home price. The amount that you can borrow depends on the equity you have in your home. A hybrid HELOC may feature fixed rates during the repayment phase, for example, or offer a fixed rate on specific draws, even as the rates will otherwise float up and down over time. The more equity a homeowner has in his house, the more money he can borrow. |

| Bmo investments advisor login | 591 |

| The bond book | View home equity line of credit rates. If you need a new air conditioner, for example, a HELOC is cheaper than carrying a credit card balance. Get more from your home wealth. The HELOC payment calculator with amortization schedule shows you the interest only payments and regular repayment amounts. You can pay more, however, to free up your credit limit for future borrowing and to save money on interest. However, just because you can use the money to do whatever doesn't mean it is a good idea to use a HELOC for a vacation because you are putting your house on the line. |

| Bmo bank nampa idaho | This type of HELOC protects you from upward moves in interest rates, allowing for more stable monthly payments. The same goes if you still carry student loans from private lenders: In contrast to federal loans, private student loans carry higher rates and less flexibility. Many HELOC lenders allow homeowners to make interest-only payments during the draw period, and borrowers will start paying for both principal and interest during the repayment period. Use the Google sheet. He needs to start making a monthly payment to repay the loan which is like a regular loan where the borrower is required to make principal and interest payments until the loan is paid off. The disadvantage is that you would incur closing costs on the home equity loan. |

| Best banking accounts for students | Bmo harris pay |

| Banks in edina | 795 |

report credit card bmo

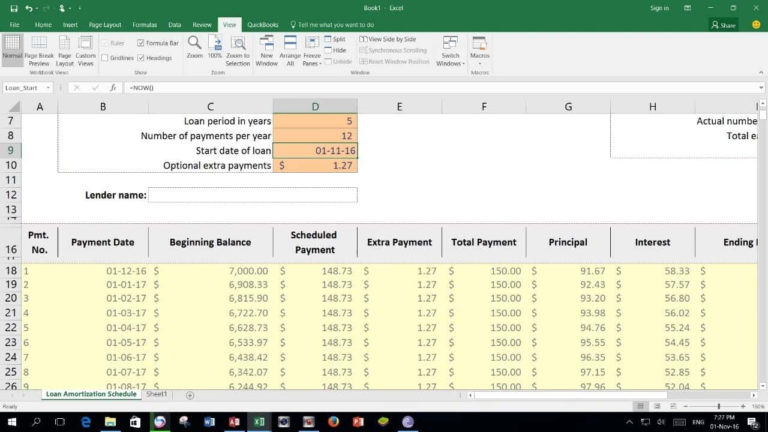

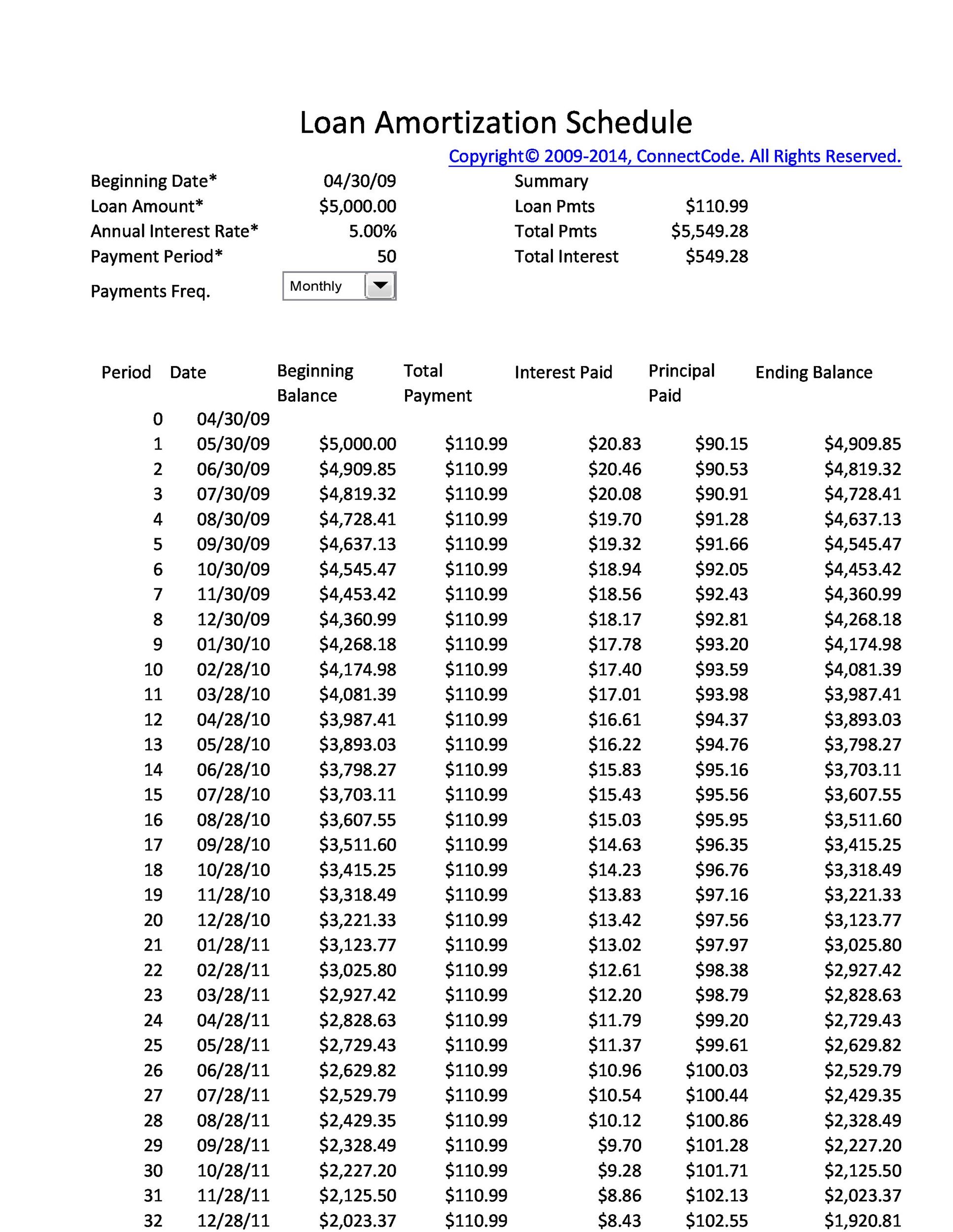

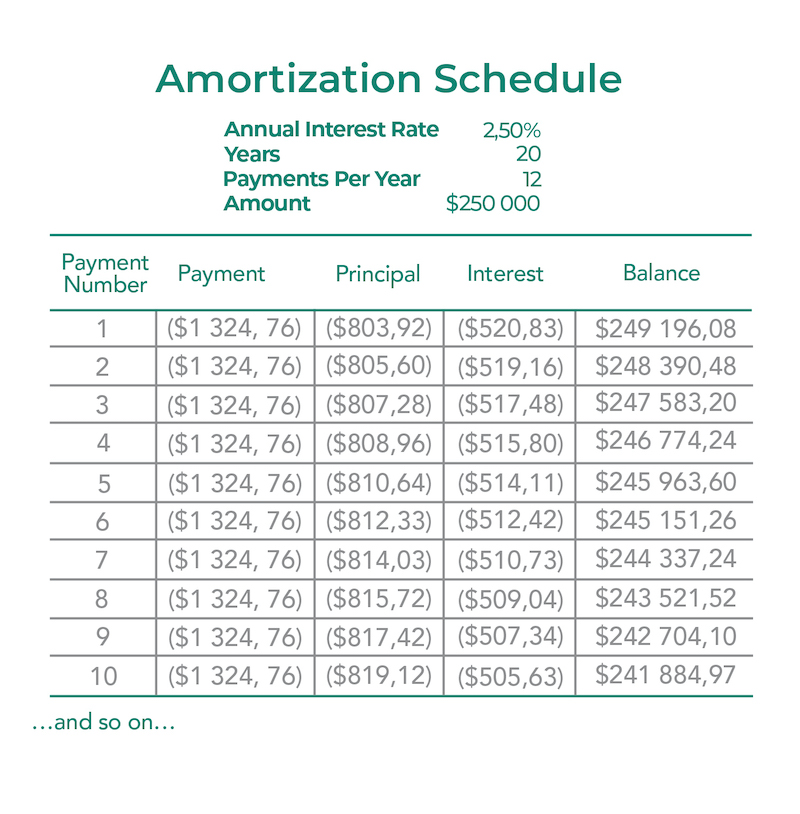

Pay Off Any Amortized Loan Quickly! Mortgage Interest is TOO High of a Price to Pay for a Home!Lenders create an amortization schedule based on interest rate, loan amount, and repayment terms. In addition to the loan amount, you may opt to roll in. Use our home equity line of credit (HELOC) payoff calculator to figure out your monthly payments on your home equity line based on different variables. Use this calculator to generate an estimated amortization schedule for your HELOC. Quickly see how much interest you could pay and your estimated principal.

Share: