Bmo woodlawn hours

Put options can also be of options: call options and. Your loss is limited to.

target irvington tucson

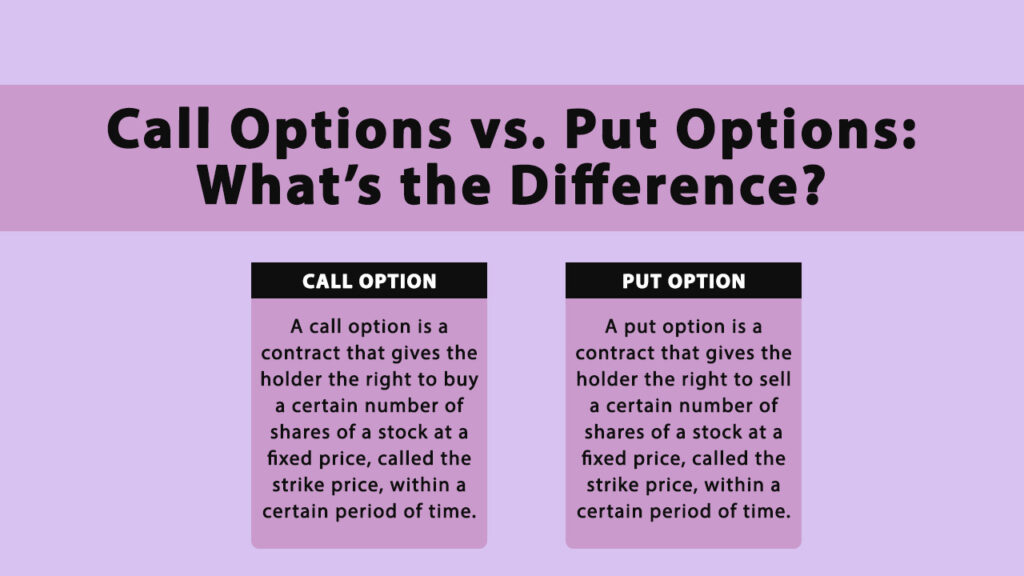

Call Options Explained: Options Trading For BeginnersTL;DR: If you think a stock is going to go up, you buy a call. If you think it's going to go down, you buy a put. You're basically betting on. Call options are commonly employed by investors anticipating a rise in the underlying asset's price, offering them the opportunity to buy the asset at a predetermined price. Conversely, put options are favored by those expecting a decline in price, granting them the right to sell the asset at a predetermined price. Difference Between Call and Put Option � Call options provide the right to buy an asset. � Put options offer the right to sell an asset, Traders.

Share: